Understanding Florida real estate titles and land records is crucial for anyone involved in property transactions in Florida. These records not only confirm ownership but also reveal any encumbrances or legal issues associated with a property. This blog will guide you through the essential aspects of Florida real estate titles and land records, including how to access and interpret these documents effectively.

Understanding Real Estate Titles in Florida

A house title represents the legal ownership of a property, signifying the rights and interests that an individual or entity holds in that property. It encompasses a “bundle of rights,” including the ability to possess, control, exclude others from, sell, and enjoy the property. While the title itself is not a physical document, it is crucial for establishing clear ownership, which can be held by individuals, couples, corporations, or trusts. A clear title indicates that the owner’s claim to the property is uncontested and free from liens or encumbrances. To ensure there are no issues with ownership, a title search is typically conducted prior to a property transaction.

Key Difference Between a Real Estate Title and a Deed in Florida

In Florida, as well as in other states, grasping the difference between a title and a deed is essential for anyone engaged in real estate dealings. While these terms may commonly be used interchangeably, they actually refer to very different aspects of property transactions.

Title: The concept of a title in real estate is not tied to a physical document but rather a legal framework that establishes property ownership. When someone holds the title to a property, they have the legal authority to use and manage the property. This includes a broad range of rights, such as possession, usage, control, enjoyment, and the right to sell the property. Moreover, a title encompasses the entire legal history of the property, detailing past ownership transfers and any legal burdens such as mortgages, liens, easements, or other encumbrances.

Deed: Contrasting with a title, a deed is a tangible legal document that actually transfers ownership of real estate from one party to another. The deed is created and signed by the property’s seller, known as the grantor, and handed over to the buyer, or grantee, effectuating the transfer of ownership. It must accurately describe the property, include signatures from the grantor, and, in Florida, be witnessed by at least two individuals. To ensure the legality of the transfer and to keep a public record, the deed must also be recorded at the county recorder’s office.

Guide to Real Estate Titling Options in Florida

In Florida, the way property is titled plays a crucial role in determining ownership rights, responsibilities, and the process of transferring property upon the owner’s death. Understanding Florida real estate titles and land records helps in recognizing different titling options, each offering distinct advantages and implications for property owners:

- Sole Ownership: Property titled in the name of a single individual grants full ownership rights to that person. This is the simplest form of property ownership and provides the owner with complete control over the property, including decisions regarding sale, lease, or transfer. Upon the owner’s death, the property is transferred according to their will or state succession laws if no will exists.

- Tenants in Common: In this type of ownership, multiple parties can jointly own property with each holding a separate, divisible interest. These shares may be equal or differ in size and can be freely sold, transferred, or mortgaged by each owner independently of the others. Crucially, there is no right of survivorship with tenants in common; if one owner dies, their share of the property passes according to their will or to their heirs, not automatically to the other owners.

- Joint Tenants with Right of Survivorship: This form of joint ownership ensures that property is held in equal shares by two or more owners. The key feature of JTWROS is the right of survivorship. This means that if one of the joint tenants dies, their share of the property immediately transfers to the surviving joint tenants, overriding any contrary provisions in the deceased’s will.

- Tenancy by the Entirety: This method of ownership is exclusively available to married couples. It shares many similarities with joint tenancy, including the right of survivorship, whereby the property seamlessly passes to the surviving spouse upon the death of the other. Additionally, tenancy by the entirety provides protection against the individual debts of one spouse; creditors of one spouse cannot claim the property as long as the other spouse is alive.

How to Obtain a Copy of Your House Title in Florida

To obtain a copy of your house title in Florida, follow these steps:

- Locate Your Property Records:

- Identify your property’s county for the correct local records.

- Visit your county’s public records or property appraiser’s website to search for your property’s deed using your address, property ID, or names involved in the transaction.

- Download or Request a Copy:

- Many county websites allow you to view and download deeds directly. For a certified copy, contact the county clerk’s office online, by mail, or in person.

- Provide necessary details like the book and page number, recording year, and party names. Fees vary by county.

- Verify Accuracy:

- Ensure the deed reflects accurate details and has been recorded properly. If discrepancies exist, consult legal help.

Overview of Accessing Property Records in Florida

Public Access to Florida’s Property Records

Florida’s public record laws allow residents to access property records freely. This transparency helps ensure accountability in real estate transactions and allows potential buyers to verify ownership and any claims against properties.

To explore property records in your area, visit Orange County’s Public Records Portal where you can search and download necessary documents.

How to Access Various Types of Property Records in Florida

To access various types of records in Florida, you can follow these methods:

- County Clerk’s Office: Most property and court records are maintained at the county level. Visit the website of the specific county clerk’s office where the property is located. Many counties provide online access to public records, including property deeds, liens, and court documents.

- Public Access to Court Electronic Records (PACER): For federal court records, you can use PACER, which allows users to access and file federal court documents electronically. Registration is required for access, and fees may apply based on usage. More information can be found at PACER.

- State and Local Government Websites: Each state has its own public records laws and guidelines. Check the Florida Department of State’s website for information on accessing state-level records, including vital statistics and historical documents.

- Online Public Records Databases: Websites like JudyRecords and others aggregate public records from various jurisdictions. These platforms can provide access to court cases, property ownership information, and more.

- Freedom of Information Act (FOIA) Requests: If you are looking for specific government-held records that are not readily available, you may file a FOIA request with the relevant agency.

- Third-Party Services: Consider using third-party services that specialize in public records searches. These services often compile data from multiple sources and can provide a comprehensive overview of public records related to individuals or properties.

For detailed instructions on accessing different types of records in Florida, including vital records and legal documents, visit the Florida Department of State.

Online Access to Florida’s Real Estate Titles and Land Records

Many counties offer online access to property titles and land records, making it easier for individuals to conduct their own searches without needing to visit offices in person. For example, start your title search at the Hillsborough County Clerk website.

How to Do a Title Search on a Property in Florida

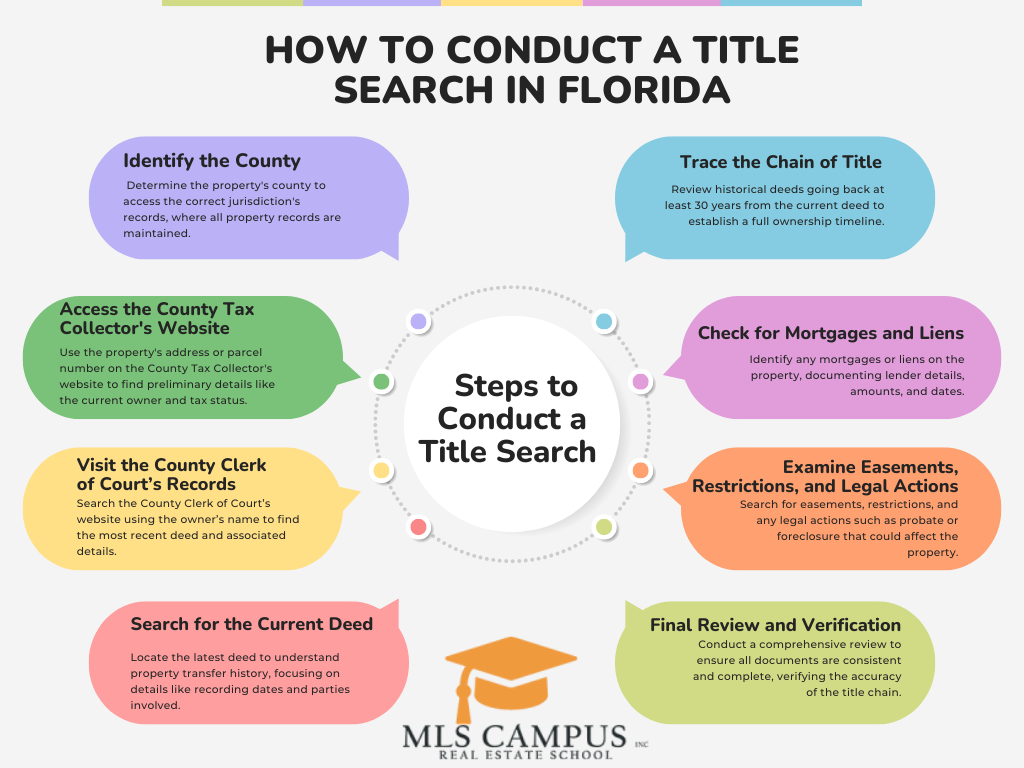

Conducting a title search involves several steps:

- Identify the County: Determine the county where the property is located, as property records are maintained at the county level. This is essential for directing your search to the correct jurisdiction.

- Access the County Tax Collector’s Website: Start your search on the County Tax Collector’s website for the specific county. Use the property’s address or parcel number to obtain preliminary details like the current owner’s name, legal description, property tax status, and any special assessments.

- Visit the County Clerk of Court’s Records: Continue your search by visiting the County Clerk of Court’s website, where official records are accessible online. Utilize the owner’s name from the tax records to locate the most recent deed associated with the property.

- Search for the Current Deed: Find the most recent deed to understand the property’s transfer history to the current owner. Pay attention to details like the book and page number, recording date, deed type (e.g., warranty or quitclaim), and the names of the grantor and grantee.

- Trace the Chain of Title: Use the details from the current deed to trace back through previous deeds. This typically involves reviewing at least 30 years of records to establish a complete ownership history and identify any potential issues.

- Check for Mortgages and Liens: Document any mortgages associated with the property, noting details such as lender names, loan amounts, and mortgage dates. Also, search for any liens or judgments against the property or its owners, including tax liens, mechanic’s liens, or HOA liens.

- Examine Easements, Restrictions, and Legal Actions: Look for recorded easements or restrictions that could impact property usage. Additionally, review probate or divorce records of previous owners to ensure correct ownership transfer and search for any foreclosure actions including lis pendens notices.

- Final Review and Verification: Once all records are gathered, conduct a final review to verify that all documents are consistent and complete. Ensure there are no discrepancies in the chain of title or unresolved issues that could affect ownership rights.

Understanding the Costs Associated with Obtaining a Title Copy and Conducting a Title Search in Florida

The costs for obtaining a title copy and conducting a title search can vary by county but generally include:

Costs for Obtaining a Title Copy:

- Copy Fees: Most counties charge a nominal fee per page for copying documents, typically ranging from $1 to $2.

- Certification Fee: If you need a certified copy of the title or deed, which is often required for legal transactions and bank dealings, counties may charge an additional fee. This fee usually ranges from $5 to $25.

- Electronic Access Fees: While many counties offer online access to documents, obtaining official copies via their websites might incur a fee, particularly for certified copies.

Costs for Conducting a Title Search:

- Basic Title Search Fees: A straightforward title search that checks for recent ownership history and liens might cost between $75 and $200. This service is usually sufficient for most residential properties.

- Comprehensive Title Search Fees: For properties with a long or complex history, or in cases involving commercial properties, the cost can rise to between $200 and $600. This extensive search delves deeper into the history, often going back 50 years or more to ensure a clear title.

Ways to Prove Ownership of a Property in Florida

To prove ownership, you typically need:

- The original deed

- A title insurance policy (if applicable)

- Any related documents such as tax receipts, mortgage statements, or other documents that provide evidence of ownership and financial responsibility related to the property.

The Importance of Accurate Property Records

Maintaining accurate property records is essential for several critical reasons in real estate transactions and ownership. These records are the foundation for establishing clear ownership and play a pivotal role in the smooth operation of the property market.

- Clear Ownership: Accurate records ensure that the title to a property is clearly defined and uncontested. This clarity is crucial when buying or selling property, as it confirms the seller’s right to transfer ownership and the buyer’s assurance of receiving rightful ownership.

- Preventing Legal Disputes: Inaccuracies in property records can lead to disputes over property boundaries, ownership rights, and the validity of prior transactions. These disputes are often complex and costly to resolve, potentially leading to litigation that could have been avoided with precise documentation.

- Information on Encumbrances: Property records detail all encumbrances, such as liens, easements, or restrictive covenants, affecting the property. These are crucial for a potential buyer or current owner to know as they can significantly impact how the property can be used, or in the case of liens, could affect the transferability of title.

- Risk Management: For lenders and insurance companies, accurate records are vital for assessing risk. They use these documents to determine the viability of a mortgage or the level of risk in providing insurance coverage. Incorrect information can lead to inadequate insurance or financial losses for lenders.

- Legal Compliance: Accurate property records help ensure compliance with local zoning laws, building codes, and tax assessments. They provide government entities with the necessary information to enforce regulations and levy taxes appropriately.

The Historical Depth of Florida’s Title Searches

In Florida, the historical depth of title searches typically extends for a minimum of 30 years. This timeframe is standard to ensure that any potential claims or issues affecting the property can be identified and addressed. However, in more complex cases or for properties with a lengthy ownership history, title searches may go back as far as 50 years or longer. The goal is to trace the chain of title from the original deed through all subsequent transfers to confirm clear ownership and identify any encumbrances, such as liens or claims against the property. The thoroughness of this process is crucial, particularly for older properties, which may have more extensive records and potential issues to investigate. Ultimately, the depth of the search will depend on the property’s history and any specific requirements set by lenders or title insurance companies.

Common Mistakes in Florida Title Searches and How to Avoid Them

Several errors can occur when conducting a title search, including relying too heavily on online records, overlooking specific types of records, and failing to establish consistent search procedures. Here are common mistakes to avoid:

Relying on online records too heavily

While online records offer convenience, they may lack critical details found in official paper documents. Important documents like liens, deeds, or mortgages are housed in courthouses and contain vital information about a property’s history. Visiting these locations ensures a thorough and accurate title search.

Overlooking judgment records

A frequent oversight in property searches is the failure to thoroughly examine judgment records available in land records offices. Judgments levied against individuals may not be immediately visible but can attach to property titles, influencing ownership rights. It is crucial, therefore, to conduct a detailed search of all judgment records at the local civil court records office to ensure a clear understanding of any encumbrances that might affect property ownership.

Neglecting probate records

Life events such as marriages, divorces, name changes, and deaths can have profound effects on property ownership. It’s essential to review probate records diligently. This is particularly important when individuals have changed their names—such as in marriage—since properties listed under a previous name may not show up in searches conducted under a new name. Ensuring all related probate records are checked is vital for a comprehensive title search, preventing potential oversights and complications in property transactions.

Failing to search all names

A thorough title search involves searching all names associated with the property to avoid oversights in property ownership.

Failing to set up specific procedures

A common oversight in property searches is the absence of standardized procedures for employees or third-party abstractors and examiners. Without uniform guidelines to follow, crucial information can be overlooked during searches. It is essential to have established protocols in place, as property searches can involve examining up to 26 different sets of public records. This ensures that all pertinent data is consistently reviewed, reducing the risk of missing critical information that could impact property transactions.

Failing to reference the legal description

When conducting property searches or reviewing a chain of title documents, it is vital to refer to the legal description of the property. The legal description provides the exact boundaries and identifiers of the property, which are paramount in determining what is being conveyed in any transaction. Reliance on the Property Identification Number (PIN), parcel number, or address alone is insufficient and can lead to errors in the property’s identification. Always ensure that the legal description is used as the primary reference to avoid potential discrepancies in property documentation.

How often should property records be updated to ensure accuracy

Property records should be updated regularly to ensure accuracy, particularly in dynamic real estate markets like Florida. Here are key insights regarding the frequency and importance of updating these records:

- Update Timelines: Generally, property records can take 4 to 8 weeks to reflect new ownership after a deed is recorded, depending on various factors such as the county’s processing speed. Some counties may provide updates more quickly, while others may take longer to make changes publicly available online1.

- Regular Review: Property owners should conduct regular reviews of their records at least every 1 to 3 years for residential properties and more frequently if there are significant changes, such as refinancing or selling. This ensures that any changes in ownership or liens are accurately reflected.

- Legal and Financial Implications: Keeping property records up to date is crucial for legal compliance and financial planning. Accurate records help avoid disputes and ensure that property owners have the necessary documentation for tax purposes and potential legal issues.

- Proactive Management: Property owners should proactively manage their records by utilizing property management software, conducting regular inspections, and updating lease agreements as necessary. This approach helps maintain accurate and current information.

Launch Your Real Estate Career in Florida with MLS Campus

At MLS Campus, we are dedicated to helping you succeed in the Florida real estate market. Whether you’re starting out or looking to advance your career, our comprehensive courses and expert mentorship are designed to equip you with the skills and knowledge necessary for success.

Why Choose MLS Campus?

Diverse Course Offerings:

- Sales Associate Pre-License (63 Hours): Jumpstart your career by getting the credentials you need to operate in Florida.

- Sales Associate Post-License (45 Hours): Enhance your skills and knowledge after your initial certification.

- Broker Pre-License (72 Hours): For seasoned associates ready to take their careers to the next level.

- Broker Post-License: Advance your expertise and prepare for a flourishing career as a broker.

- Continuing Education (14 Hours): Keep up with industry changes and fulfill ongoing licensing requirements.

- Reactivation (28 Hours): Reactivate your inactive license and return to your real estate practice with confidence.

Expert Instruction and Support

Benefit from experienced instructors and reliable tech support.

Flexible Learning Options

Our user-friendly platform allows you to study at your own pace, anytime and anywhere, using any device—PC, Mac, tablet, or smartphone.

Get Started Today!

30 Days Limited Money Back Guarantee Policy

If you decide you’re not 100% satisfied within the First 30 Days of your initial purchase, simply contact us by email and request a cancellation and full refund. You will receive a full refund of your purchase price. If the final exam has been taken, a refund can not be issued. The Real Estate Exam Prep Master and the Exam Prep Math, if purchased separately are not refundable.

Course Duration

The course is active for six months from the date of purchase. We offer the 7th month for free if needed. If your course has been active for 7 months or more, you can purchase one-month extensions. It is possible to have the course extended by up to one year by purchasing monthly extensions online.

Customer Support: Call us at (877) 331-6235 or Contact us by Email

If we can assist you with Technical Support, General License Inquiries or Questions about Course Material please contact us.

Questions about course material: An Instructor is available Monday through Friday a week from 9 am to 7 pm (EST)

Technical Support or any other questions: Our office staff are available Monday through Friday a week from 9 am to 7 pm (EST)

We do our best to reply promptly to emails on Weekends

*Except for Major Holidays

Join Over 100,000 Students Enroll With MLS Campus now

Become Part of MLS Campus School to Further Your Career.